When considering buying a foreclosure property, one of the most common questions people ask is, “Should I just call the listing Realtor®?” While it may seem like the simplest option, it’s important to understand the unique nature of foreclosure transactions and why having your own representation can make all the difference.

Why Calgary Foreclosures Are Different from Regular Listings

In a typical real estate transaction, the listing Realtor® represents the seller’s interests. Their job is to provide as much information as possible about the property to attract buyers and secure the best deal for their client. However, foreclosures operate under a completely different set of rules.

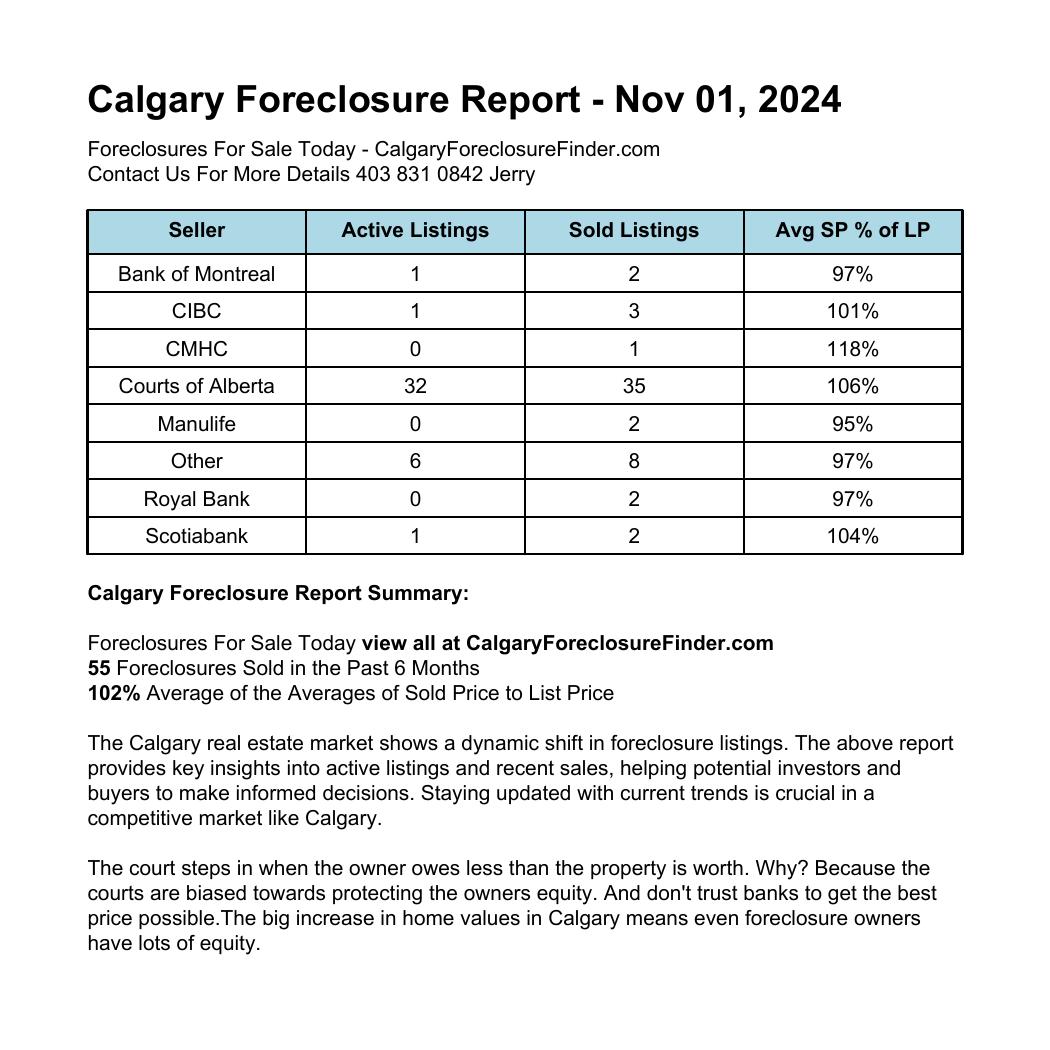

Foreclosed properties in Calgary are sold “As Is,” which means the seller—often a bank or other financial institution—is not making any guarantees about the property’s condition. These sellers are primarily focused on minimizing their risks, not necessarily making the process easy or transparent for buyers. As a result, listing Realtors® for foreclosed properties are often instructed to withhold certain details to avoid any potential liability issues for the seller. This lack of information can leave buyers in the dark about crucial factors, such as:

The property’s condition

Outstanding liens or legal issues

Past damage or repairs

Potential risks or hidden costs

The Risks of Calling the Listing Realtor®

If you decide to call the listing Realtor® directly, it’s essential to remember that they are legally bound to prioritize the seller’s interests, not yours. This conflict of interest means you may not receive the guidance or insights needed to make an informed decision. For example:

The listing Realtor® may not disclose all the information they have about the property’s history or condition.

They may downplay potential risks to encourage a quicker sale.

They might prioritize offers that align with the seller’s goals, even if those offers aren’t in your best interest.

While calling the listing Realtor® might save time in the short term, it could lead to costly mistakes or missed opportunities in the long run.

The Value of Having an Experienced Professional on Your Side

Navigating the complexities of a foreclosure purchase requires expertise, diligence, and a clear understanding of the foreclosure buying process. That’s why it’s crucial to have an experienced Calgary real estate professional representing your interests. Here’s how they can help:

1. Unbiased Guidance: An Independent Calgary Realtor® like Jerry Charlton works exclusively for you, ensuring your best interests are the top priority.

2. In-Depth Knowledge: They understand the foreclosure process, including the legal and financial intricacies, and can help you avoid common pitfalls.

3. Access to Information: A knowledgeable Realtor® can uncover important details about the property that the listing Realtor® may not disclose.

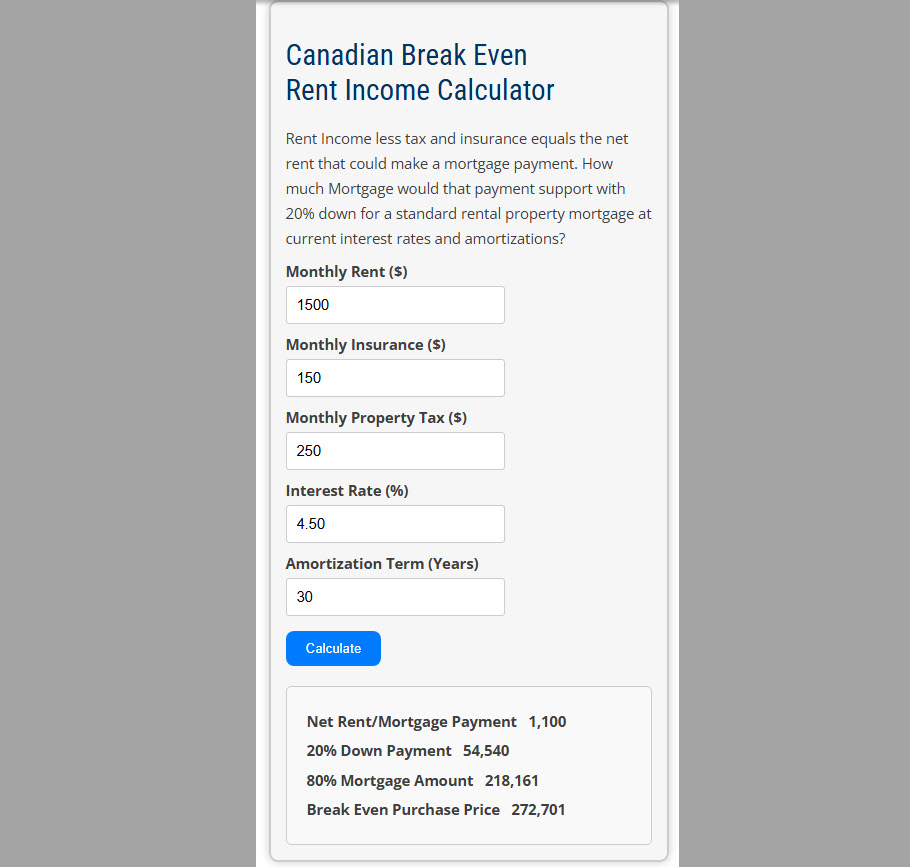

4. Negotiation Expertise: Calgary Foreclosure purchases often involve complex negotiations. Your Realtor® can advocate on your behalf to secure the best deal.

5. Risk Management: They can help you assess potential risks and make informed decisions to protect your investment.

Avoiding Costly Mistakes

Buying a foreclosed property can be an excellent opportunity to secure a great deal, but it’s not without its challenges. Relying solely on the listing Realtor® leaves you vulnerable to incomplete information, biased advice, and potentially costly mistakes. By partnering with a professional who has your back, you can confidently navigate the process and make a sound investment.

Final Thoughts

While it is technically possible to call the listing Realtor® for a foreclosure property, it’s rarely the best approach. Foreclosures are unique transactions that require a thorough understanding of the process and an advocate who will look out for your interests. Don’t leave your investment to chance—work with an experienced real estate professional who can guide you every step of the way.

If you’re considering purchasing a Calgary foreclosure property, reach out to a trusted Realtor® like Jerry Charlton who specializes in these types of transactions. With the right expertise on your side, you can turn a potentially complicated process into a successful real estate opportunity.