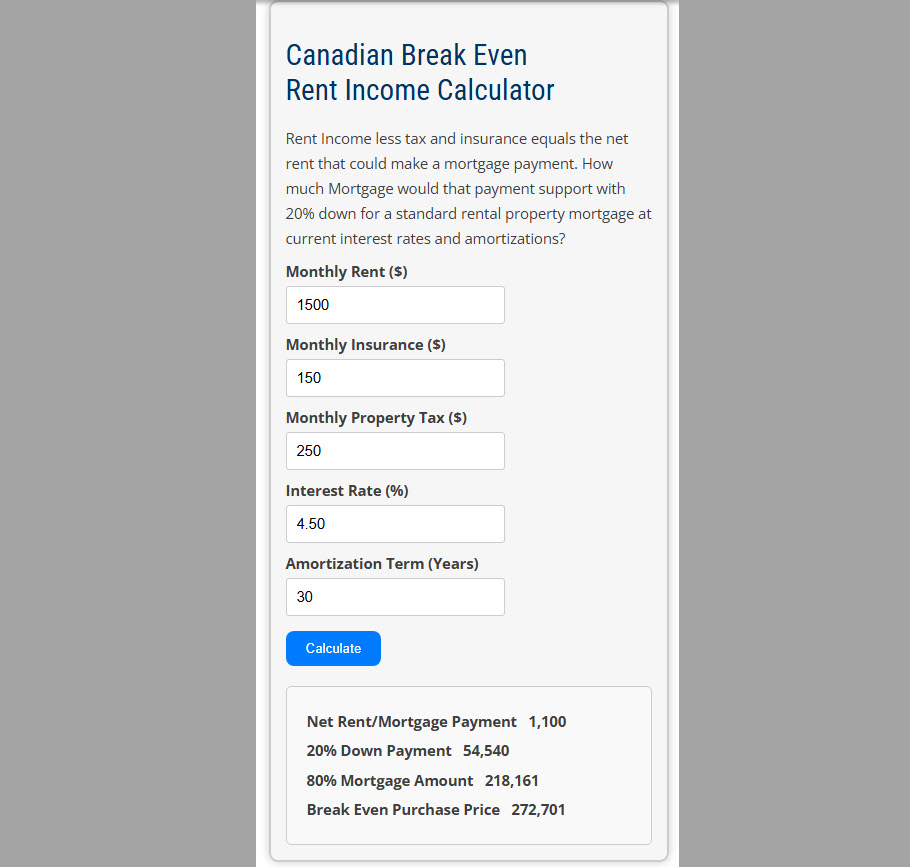

Investing in single-family rental properties begins with knowing your break-even point. At its core, this calculation helps determine the maximum purchase price a rental property can support based on its rent income.

Step 1: Calculate Net Rent

Start by subtracting property taxes and insurance costs from your total monthly rent income. This net rent is what’s left to cover your mortgage payment.

Step 2: Determine Your Break-Even Price

Using the net rent, estimate the mortgage it could support at current interest rates with a standard 20% down payment. This approach gives you a break-even purchase price—an essential figure for cash flow analysis.

Explore Your Options with the Canadian Break Even Rent Income Calculator

Our calculator simplifies these steps, allowing investors to enter their expected rental income, property tax, insurance, and loan details. Get an instant estimate of your property’s break-even price and start making data-driven decisions in Calgary’s rental market.

Comments:

Post Your Comment: