Whether you’re a first-time home buyer, investor, or homeowner thinking about selling, understanding the current housing market is crucial. Calgary’s latest Total Residential Home Market Watch Report from July 28, 2025, offers revealing insights into pricing trends, inventory, and buyer activity.

Here are 5 key takeaways from the data that could shape your next move:

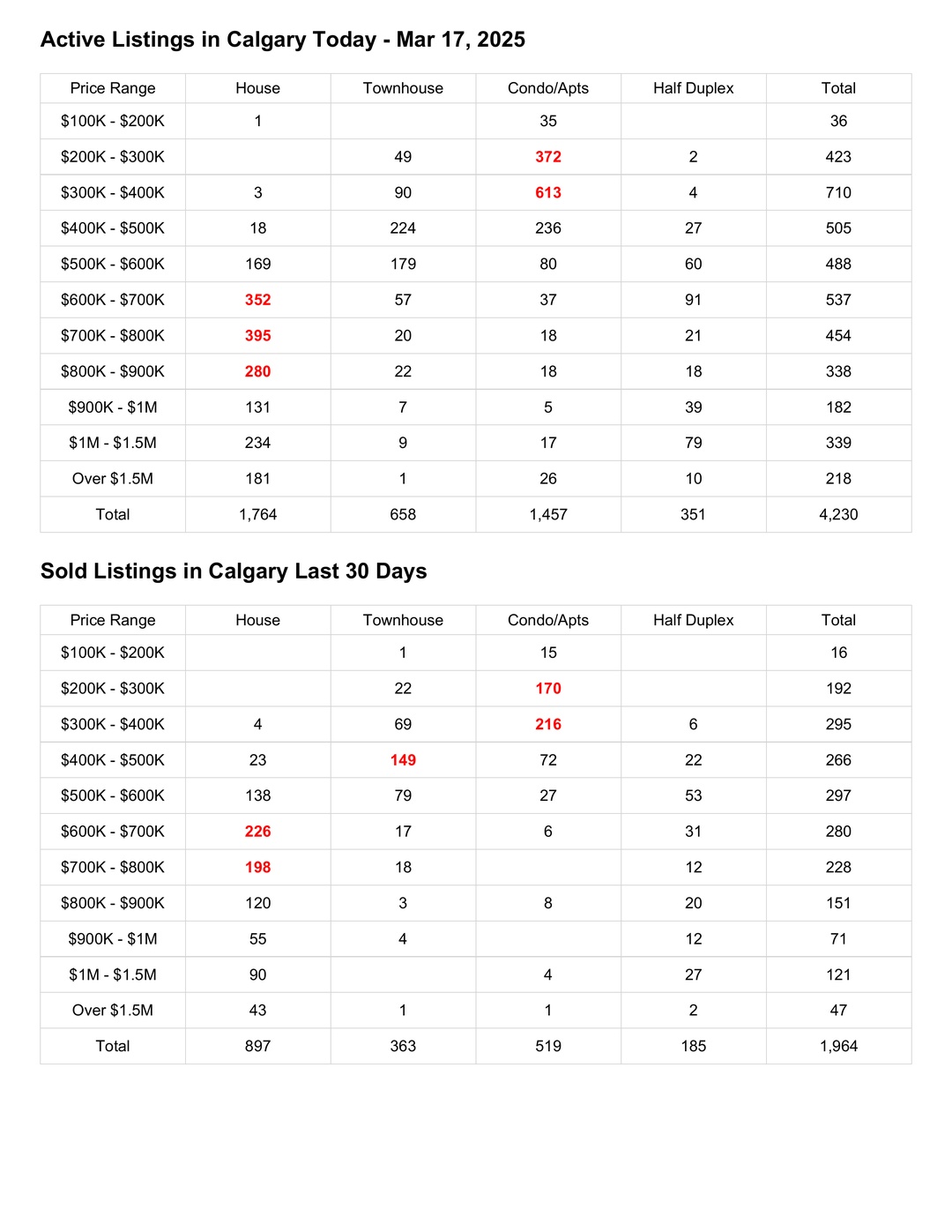

1. 🔥 The $500K–$600K Price Range is the Most Active Segment

891 active listings and 286 sales in the past 30 days make this price range a hotspot for both buyers and sellers. It’s especially strong for detached homes, which sold 179 units—the highest in any price category.

Why it matters: This range offers a sweet spot of affordability and selection. If you're looking to buy or sell a detached home in Calgary, this is your most competitive range right now.

2. 🏢 Condos Are Still the Most Available—But Not Always the Fastest Moving

With 1,988 condos for sale across all price brackets and 484 sales last month, condos represent the largest share of inventory. However, the months of supply for condos is 4.1, higher than other property types.

Takeaway for buyers: There's more room to negotiate on condos, especially in the $300K–$400K range where 776 are active but only 183 sold.

3. 💡 Inventory is Tightest for Half Duplexes

Despite having only 511 active listings, half duplexes saw 176 sales, giving them the lowest months of supply at just 2.9.

What this means: Half duplexes are in demand and moving fast—particularly in the $400K–$600K range. If you’re looking to buy one, act quickly and be prepared.

4. 💸 The High-End Market ($1M+) Is Gaining Momentum

There were 676 active listings over $1M and 156 sold—a healthy 23% absorption rate. Detached homes make up most of this movement, with 92 sales between $1M–$1.5M and 33 sales over $1.5M.

Insight for luxury buyers/sellers: The luxury real estate market in Calgary is showing strong interest, particularly in desirable areas with move-in-ready homes.

5. 📉 Price Pressure May Be Building in the $300K–$400K Range

This segment had the highest number of total active listings (990) but relatively low sales volume (294), resulting in higher months of supply. It's especially noticeable for condos and townhouses.

Advice for sellers: If you're listing in this range, especially with a condo or townhouse, pricing strategically and staging professionally is more important than ever.

🧠 Final Thoughts

Calgary’s real estate market remains active and segmented. Whether you're looking to invest in Calgary homes, downsize, or upgrade, understanding which segments are hot and which are cooling off can help you make a better decision.

➡️ For full market data and your community-specific insights, visit 365Calgary.com