Posted on

June 14, 2025

by

J. Charlton

Whether you're buying your first rental or your fiftieth flip, the smartest investors all have one thing in common: they ask the right questions before they buy.

If you're even thinking about purchasing a property in Calgary for investment, there's one free download you should grab before anything else:

👉 Download the 2025 Real Estate Investor Questions PDF

This isn't just a checklist. It's your personal due diligence tool.

Why Most Investment Mistakes Happen Before You Even Make an Offer

Let’s face it: many investors fall in love with the wrong property.

Not because the numbers don’t work (though they often don’t)...

But because they never paused to ask: Do the numbers work for my goals?

The Investor Questions 2025 PDF helps you filter opportunities based on:

Your investment goals (cash flow, appreciation, tax shelter?)

Your risk tolerance

Your financial reality

Your management preferences

Your ideal tenant profile

Before running ROI spreadsheets or calculating break-even rent, you’ll want to clarify what kind of investor you really are. This guide helps you do exactly that.

🎯 Get your free copy now and get intentional about your next deal.

A Peek Inside the Guide (And Why It's So Useful)

This isn't theory. It's practical, real-world investor thinking broken into 6 laser-focused sections:

🏁 1. Your Goals & Strategy

Are you holding long-term? Flipping? Looking for a tax write-off? Your answer affects everything—from location to property type.

💰 2. Your Financial Position

What’s your true budget when you factor in renos, closing costs, and vacancies? Will you buy personally or through a holding company?

🏘️ 3. Property Preferences

Do you want a suited bungalow in the northeast or a turnkey condo in the Beltline? The guide helps you narrow your scope intentionally.

🔧 4. Management & Maintenance

Are you swinging a hammer or calling a property manager? This changes how you should underwrite each deal.

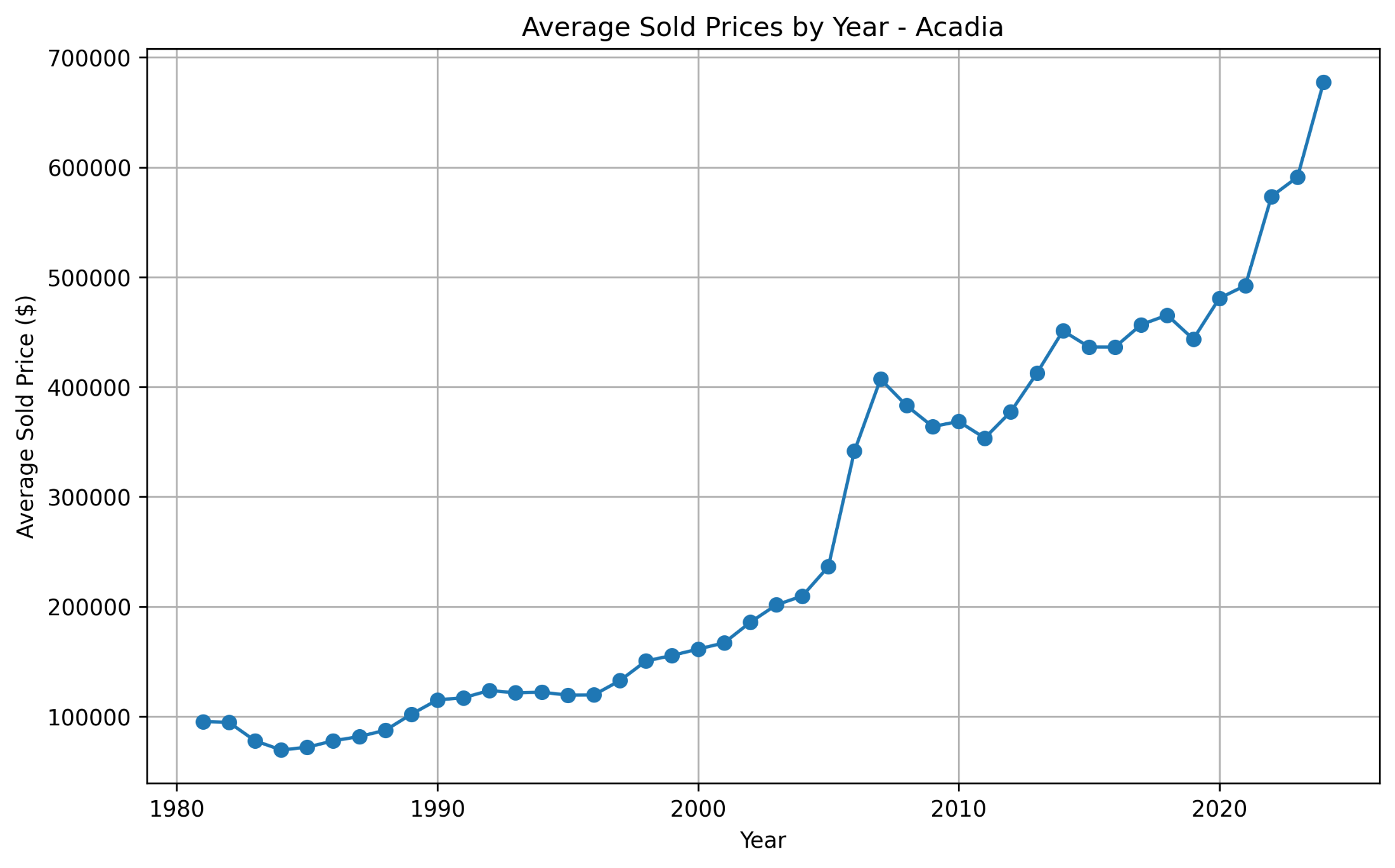

📈 5. Market Expectations

Know what to expect in Calgary’s rental market. Are you targeting students, families, or professionals? That choice affects rent, turnover, and risk.

⚖️ 6. Legal & Tax Considerations

If you’re not accounting for depreciation, tax deferral, or Alberta tenancy laws, you could be leaving thousands on the table—or risking legal trouble.

Real Estate in Calgary Offers More Than Just Appreciation

Here’s something most people overlook: real estate can be a legal tax shelter.

Yes, seriously.

From Capital Cost Allowance to deductible expenses to loss carry-forwards, investing in Calgary property can significantly reduce your taxable income over time—if you structure things correctly.

The guide breaks it down simply and gives examples like:

Offsetting $5,000 in rental income with $5,000 in depreciation = zero taxable income

Carrying forward early-year losses to reduce future gains

Deferring capital gains tax until you sell, not while the property grows

📥 Download the full Investor Questions 2025 PDF to explore all 24 questions and the bonus tax tips that come with it.

Final Thought: Properties Don’t Make You Money—Smart Decisions Do

This simple yet powerful document has helped dozens of Calgary investors avoid costly mistakes and spot better opportunities.

So before you scroll another MLS listing, get clear on your investment profile.

Then find a property that matches you—not the other way around.