Foreclosures are often seen as a golden opportunity for buyers seeking a great deal, but court-ordered Calgary foreclosures are far from straightforward. If you're considering purchasing a foreclosed property, it's crucial to understand the Court of Kings Bench Foreclosure Sale Process—a complex legal procedure designed to protect the rights of both homeowners and lenders.

In this guide, we’ll take you through everything you need to know, from understanding the role of the court to navigating the purchase process. Let’s dive in!

Understanding the Court’s Role in Calgary Foreclosures

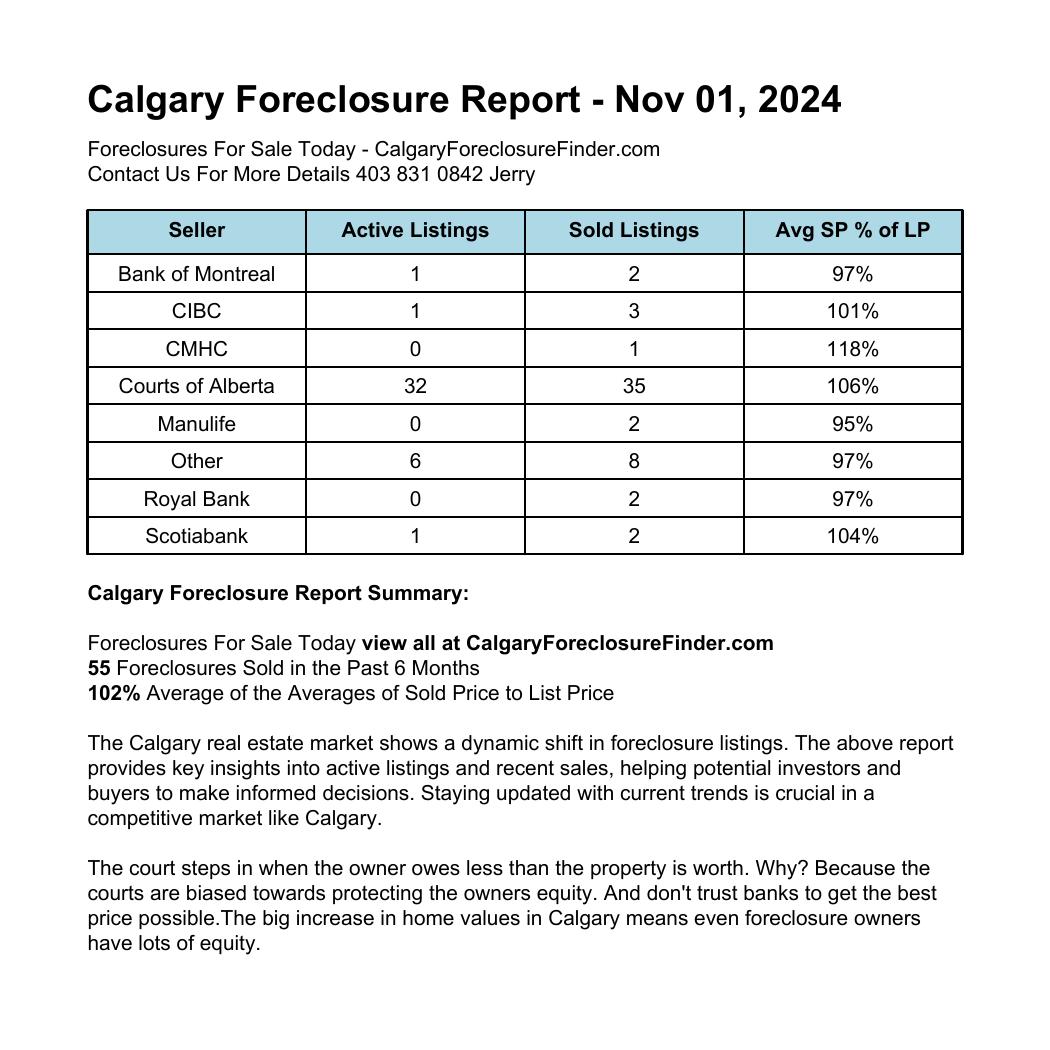

Unlike standard sales, the Court of Kings Bench is the legal seller when it comes to foreclosures. Their role is to ensure the foreclosure process is conducted fairly, avoiding situations where lenders sell properties at fire-sale prices, thereby safeguarding homeowners’ equity. In short, the court serves as a middleman to balance what the owner owes with the actual market value of the home.

This means the court is not just a neutral party; it actually favors the owner whenever possible, ensuring they are protected from losing their home at a drastic discount. This protective stance makes buying a foreclosed property more nuanced but also more rewarding for buyers who know the rules of the game.

The Property Details: What You Need to Know

Before diving into the purchase process, it's crucial to understand the key details about the property in a court-ordered foreclosure:

1. The legal title remains in the owner’s name until the sale is finalized. This means the original homeowner retains some rights until the very end.

2. The property is generally worth more than the debt that the owner owes. This is important because it explains why the court gets involved—to ensure the owner gets a fair shake.

3. The owner has the right to stop the foreclosure at any time by paying off overdue payments plus any associated fees. This can happen right up until the moment the sale is approved by a judge, meaning there is a level of uncertainty for potential buyers.

How to Make an Offer: The Court-Ordered Foreclosure Process

Buying a foreclosed property through the court is not like a typical real estate transaction. Here’s how the process works and what you should expect:

1. All Offers Must Be Unconditional

If you’re thinking about including a “Subject to Financing” or “Subject to Inspection” clause, think again. All offers must be unconditional, with no room for negotiation or contingencies. This can be intimidating for many buyers because it requires a high level of confidence—and cash on hand.

2. No Documents Provided by the Court

The court will not supply condo documents, Real Property Reports, or any other important information. It’s up to you to conduct your own research and ensure that you’re fully informed about what you’re buying.

3. A Stripped-Down Offer Format

Offers are made using the Standard Real Estate Offer, but with all buyer rights and protections deleted. This means the typical clauses that protect buyers (like inspection or financing conditions) are gone. As a buyer, you’re assuming all the risks.

4. Lawyers Review All Offers

Once you submit an offer, it’s reviewed by the bank’s lawyers. They ensure that all legal procedures are followed and that the offer is in the bank's best interest before it’s considered by the court.

5. Lawyers Determine if an Offer Should Be Considered by the Court

If your offer passes the initial review, the lawyers then decide whether it’s worth presenting to the court. Not all offers make it to the next step, so ensure yours is competitive and well-prepared.

6. Court Date Set for Offers

If the lawyers believe your offer has potential, they arrange a court date. This is when the judge will review all qualifying offers.

7. Waiting for the Court’s Decision

On the appointed date, the lawyers will appear in court to present the offer. Patience is key here—sometimes cases are delayed or postponed, adding to the uncertainty.

8. Judge’s Decision

The judge has the authority to accept an offer or reject all offers. Even if you’re the highest bidder, there’s no guarantee the judge will accept your offer. The court aims to balance the interests of all parties, especially the original owner.

9. Finalizing the Sale

If your offer is accepted, the court will set a date by which the balance must be paid. Once the payment is complete, ownership is transferred, usually within 30 days. At this point, the property officially becomes yours, and you’re responsible for any repairs or issues.

Is Buying a Foreclosure Right for You?

Court-ordered foreclosures can be an excellent opportunity for those who understand the risks and are prepared to act quickly. However, it’s not for the faint of heart. You need to be ready to buy without the usual safeguards—no inspections, no conditions, and no guarantees.

If you’re considering this route, working with an experienced Calgary Realtor who understands the foreclosure process is a must. They can help you navigate the complexities, prepare a solid offer, and guide you through the court system.

Ready to Explore Foreclosures in Calgary?

Buying a foreclosed property isn’t easy, but with the right preparation and support, it can be an incredibly rewarding investment. Contact Us today if you’re ready to take the plunge or have more questions. We’re here to help you find opportunities in Calgary’s foreclosure market.