Unlocking the Power of Data: Jerry Charlton’s Interactive Calgary Real Estate Visual in Power BI

In the ever-evolving world of real estate, information is power. Whether you’re a homebuyer, seller, or investor, making informed decisions is crucial to success. Jerry Charlton, a busy Calgary Realtor, has harnessed the power of data to create an extraordinary interactive visual in Power BI that offers unparalleled insights into the Calgary real estate market. This tool, with its comprehensive data and user-friendly interface, is designed to help you navigate the complexities of buying, selling, and investing in Calgary’s diverse neighborhoods.

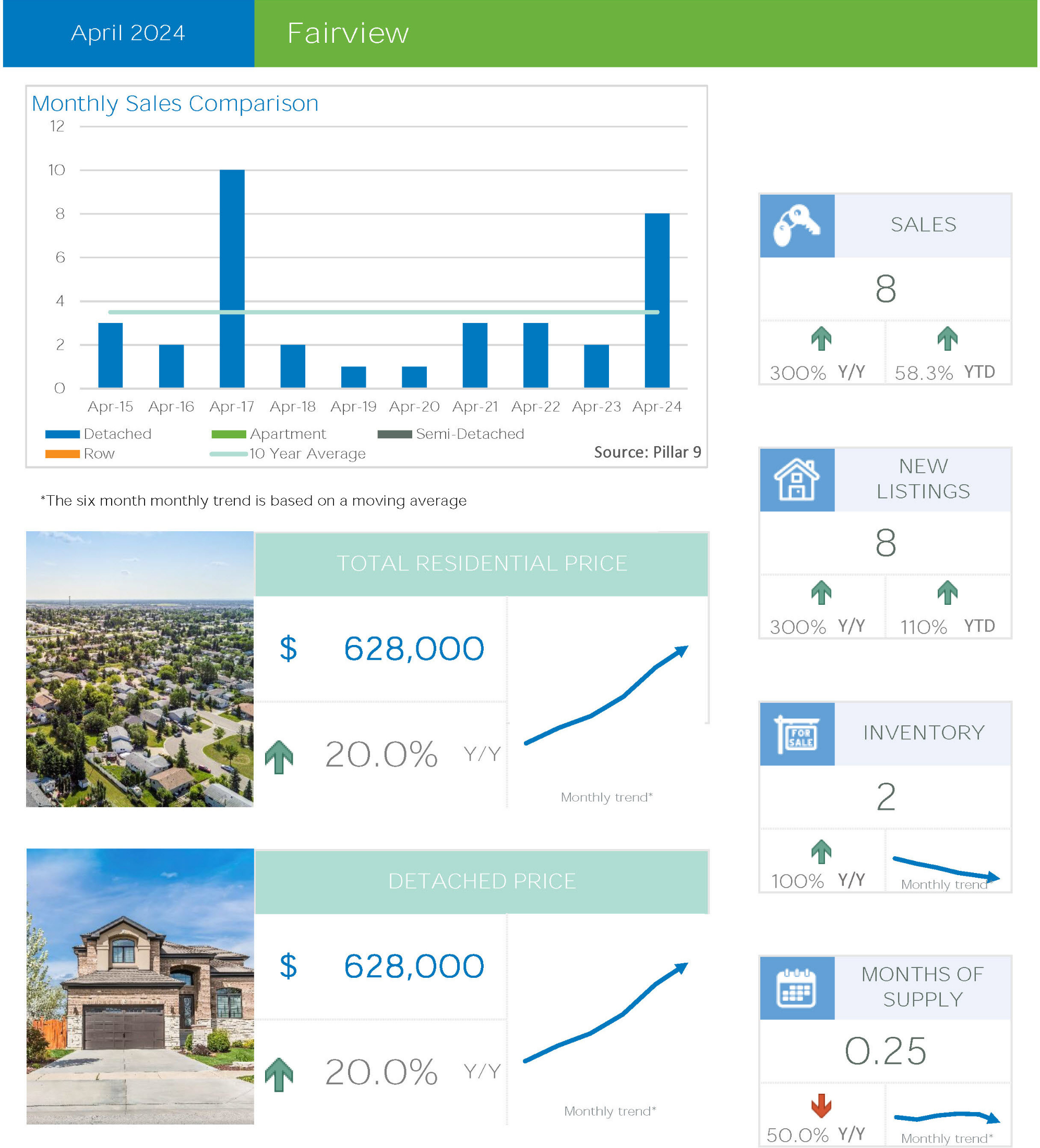

The Comprehensive Overview: Exploring Over 200 Calgary Communities

The first page of this interactive visual is a treasure trove of information. It allows users to choose from over 200 communities in Calgary, offering a granular view of the real estate landscape. Once a community is selected, you can further refine your search by choosing the type of home: Detached, Attached, Apartments, or Half Duplexes. This specificity ensures that you get the most relevant data tailored to your needs.

Key Metrics at Your Fingertips

On this page, the tool presents crucial metrics, including the number of sales, property style, minimum and maximum sold prices, average sold prices and average sold prices per square foot. Additionally, a map shows the exact locations of these homes within the chosen community, providing a visual representation of the market distribution.

This wealth of data is invaluable for understanding the market dynamics in any given community. Whether you’re curious about the price range of detached homes in a specific area or want to see where most apartments are selling, this page offers a clear and detailed overview.

Recent Sales: Diving into the Details

The Recent Sales page takes the data a step further, offering a list of actual sales. This page is particularly useful for those who want to delve into the specifics of recent transactions.

Detailed Transaction Data

For each sale, the visual provides the sold date, original list price, sold price, percentage of sold price to list price, days on the market (DOM), sold price per square foot, size, address, number of bedrooms and bathrooms, whether there’s an ensuite, if there’s a garage, and the style of the home.

This detailed breakdown allows you to see how individual properties are performing relative to their list prices and how quickly they’re selling. It’s an excellent resource for both buyers and sellers looking to gauge market activity and trends.

Historical Trends: Average Prices Over Time

For investors and analysts, understanding historical price trends is essential. The Avg Prices page provides a comprehensive view of the market over the past decade, showing yearly high, low, and average prices for both sale prices and sale prices per square foot.

Visualizing Market Trends

This page features a graph that tracks these prices over time, offering a clear picture of how the market has evolved. This historical data is particularly useful for identifying long-term trends and patterns, helping investors make informed decisions about where and when to invest.

Size vs. Price: The Scatter Chart

The Size/Price Chart is another powerful tool within this interactive visual. It shows sales from the past 180 days on a scatter chart, with size in square feet along the bottom and sold prices along the side. Each dot on the chart represents an actual sale, providing a visual representation of the relationship between home size and sale price.

Insights at a Glance

This scatter chart is incredibly useful for identifying outliers and trends in the market. For instance, you can quickly see if larger homes are consistently selling for higher prices or if there’s a wide range of prices for homes of similar sizes. This information can be crucial for pricing strategies and understanding market value.

A Tool for Everyone

Combined, these four pages offer a wealth of information to home buyers, sellers, and investors looking to make better-informed decisions in the Calgary real estate market. Jerry Charlton’s interactive visual in Power BI is not just a tool; it’s a comprehensive resource that brings transparency and clarity to the real estate market.

Empowering Home Buyers

For home buyers, this tool provides a detailed understanding of the market dynamics in their desired communities. By exploring the number of sales, property styles, and price ranges, buyers can make informed decisions about where to purchase. The Recent Sales page offers a glimpse into what similar homes have sold for, helping buyers set realistic expectations and make competitive offers.

Supporting Sellers

Sellers benefit immensely from this tool as well. By understanding the average sold prices and market trends, they can price their homes more accurately and strategically. The detailed transaction data provides insights into how quickly homes are selling and at what prices, enabling sellers to position their properties effectively in the market.

Guiding Investors

Investors, perhaps more than anyone, rely on data to make profitable decisions. The historical price trends and scatter charts offer valuable insights into market fluctuations and potential investment opportunities. By identifying communities with stable or rising prices, investors can make informed choices about where to allocate their resources.

Jerry Charlton’s interactive visual in Power BI is a game-changer for the Calgary real estate market. By providing detailed, accurate, and up-to-date information, this tool empowers home buyers, sellers, and investors to make smarter decisions. Whether you’re looking to buy your first home, sell a property, or invest in Calgary’s vibrant real estate market, this interactive visual offers the insights you need to succeed. Explore it today and unlock the power of data in your real estate journey.

.png)

.png)

.png)