Thinking about moving to Canada, and particularly Calgary? You’re not alone! Calgary has become a top destination for individuals and families looking for a unique balance of urban amenities and natural beauty. Whether you're relocating for work, education, or simply seeking a new lifestyle, understanding Calgary's housing market can be a significant factor in making your decision. Let’s dive into a detailed look at Calgary’s real estate trends with insights into the average daily sales over the past five years.

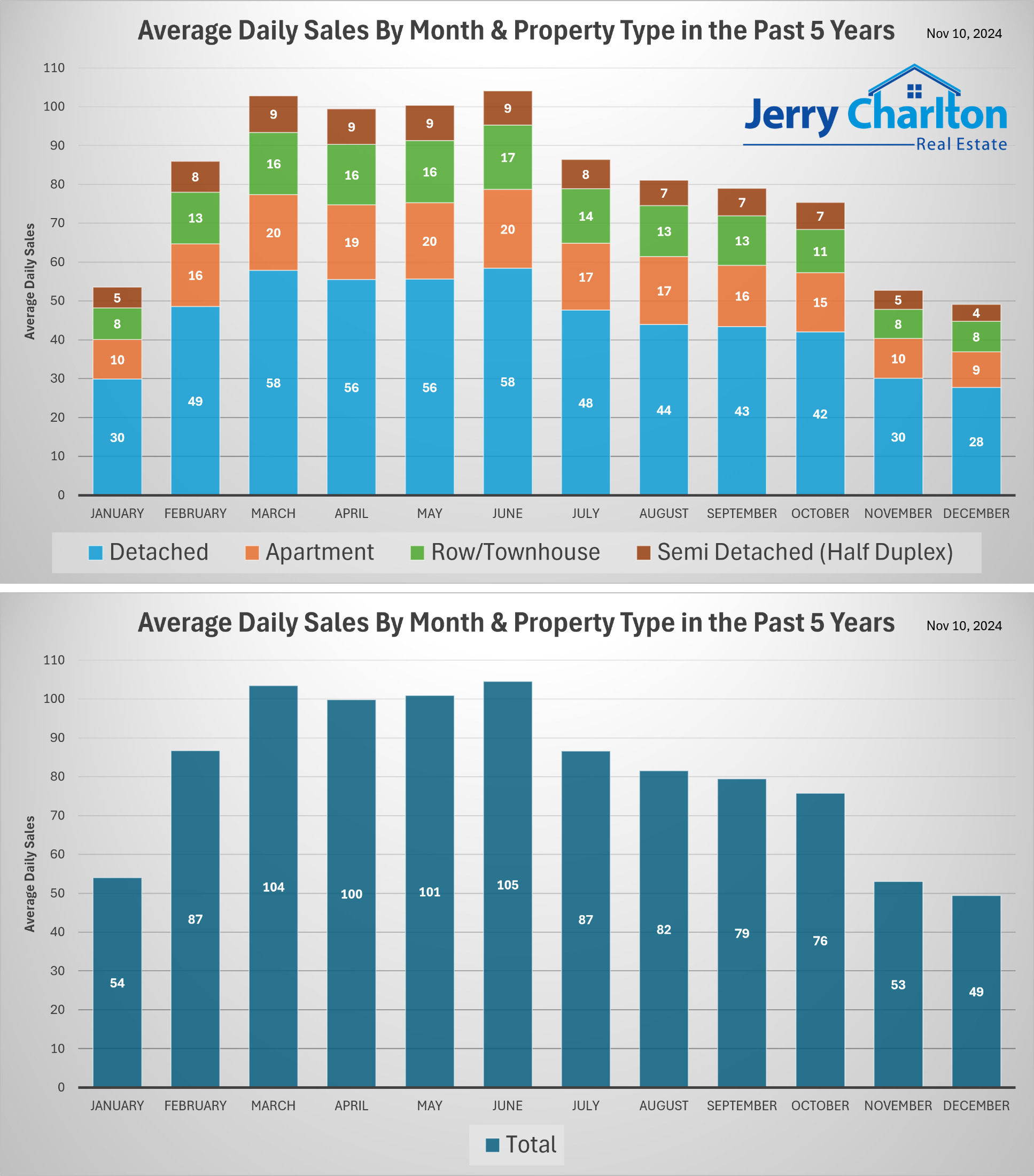

In this post, we’ll break down the information from the two insightful charts above, each presenting a perspective on Calgary’s real estate landscape by examining average daily sales of various property types. This analysis will help you understand the rhythm of Calgary’s housing market, what kinds of homes people are buying, and when activity tends to peak and dip throughout the year.

Chart Analysis: Average Daily Sales by Property Type

The first chart focuses on average daily sales for each property type—Detached, Apartment, Row/Townhouse, and Semi-Detached (Half Duplex). Here’s a month-by-month breakdown of each type:

1. January to March - A Steady Start to the Year

The year starts off steady in January, with detached homes dominating sales (around 30 daily on average) and moderate sales across other types. By February, the market gains momentum, particularly for detached homes (49) and apartments (16), signaling the beginning of the spring market buildup. March sees an even higher increase in daily sales across all property types, with detached homes hitting an average of 58 sales per day.

2. April to June - The Market Heats Up

April through June is Calgary’s prime real estate season. Detached homes consistently lead in sales (56 to 58 per day), but there's a significant boost across all property types. For instance, apartment sales rise to about 20 daily in May, while row/townhouses and semi-detached properties also see increases, likely reflecting higher demand from first-time buyers or those seeking more affordable options than single-family detached homes. This spring surge aligns with warmer weather, making it easier for buyers to move and sellers to showcase properties.

3. July to September - Sustained Activity with a Slow Descent

Although the market remains strong in the summer months, July marks the beginning of a slight dip. Detached homes still lead (with about 48 daily sales), while apartments, row/townhouses, and semi-detached homes also retain steady interest. August and September continue this trend, with a gentle decline in sales numbers across all property types. The market typically cools slightly as summer vacations wind down and families prepare for the back-to-school season.

4. October to December - The Year Winds Down

The final quarter of the year shows a gradual decrease in daily sales, with detached homes averaging around 30 daily sales by November. Other property types, such as apartments and semi-detached homes, see a similar decline. By December, average daily sales are at their lowest for the year, reflecting the market’s seasonal nature as people focus on holidays rather than moving. However, this can also be a strategic time for motivated buyers and sellers to find deals with potentially less competition.

Chart Analysis: Total Average Daily Sales by Month

The second chart provides a broader view, showing the total average daily sales across all property types each month.

Spring Peaks: The data reinforces that Calgary’s market peaks between March and June, with average daily sales reaching their highest point in May (105 daily sales). For those considering a move, this is when the market is most competitive, with many buyers and sellers actively participating.

Summer and Fall Decline: July marks the start of a gradual decrease in activity, dropping from 87 daily sales in July to 76 by October. This cooling phase may be attractive for buyers looking for less competition, though inventory may also reduce.

Winter Slowdown: November and December show the lowest sales volumes, averaging just 53 and 49 daily sales, respectively. Winter can be a quieter time in the Calgary real estate market, possibly leading to better opportunities for buyers who want to avoid bidding wars.

Key Takeaways for Prospective Calgary Residents

Timing Your Move: If you’re moving to Calgary with the intent to purchase property, consider timing your search according to market trends. Spring and early summer are bustling, with high availability and a diverse range of homes on offer. However, if you’re looking to avoid peak competition, late fall and winter could offer a quieter market with less pressure.

Choosing Your Property Type: Detached homes consistently lead the market in popularity, which aligns with Calgary’s appeal as a family-friendly city with abundant space. However, there’s a consistent interest in apartments, row/townhouses, and semi-detached homes, appealing to a wide demographic of buyers from single professionals to young families and downsizers. Apartments are especially popular during peak months, likely driven by affordability and location in the city's core.

Understanding Market Fluctuations: Calgary’s market is seasonal, which is essential for any prospective buyer or seller to understand. If you’re planning to sell, listing in the spring could yield more interest and potentially a quicker sale. Buyers should be aware that while spring offers more options, it also brings increased competition.

Real Estate as an Investment: For investors, Calgary’s consistent activity across all property types suggests a stable market with opportunities in various sectors. Detached homes, while pricier, are in continuous demand, while apartments and townhouses offer more accessible entry points with reliable turnover.

Calgary’s housing market reflects the city’s vibrant lifestyle and seasonal rhythm. This detailed look at average daily sales across property types and months over the past five years offers valuable insights for those considering a move. Whether you’re drawn to Calgary for its job opportunities, educational institutions, or stunning natural surroundings, the real estate market offers something for everyone. From bustling spring sales to the quieter winter months, each season brings unique advantages depending on your goals.

If you’re planning a move to Calgary, understanding these market dynamics will empower you to make informed decisions, whether you’re buying, selling, or investing. Embrace the timing that works best for you and dive into Calgary’s real estate landscape with confidence—your new life in Canada awaits!