The Calgary Real Estate Market includes everything, everywhere in the city.

That’s not your real estate market. Erase that misconception now.

Your Real Estate Market is unique to you and your needs.

Defining Your Real Estate Market

Three key factors define your real estate market:

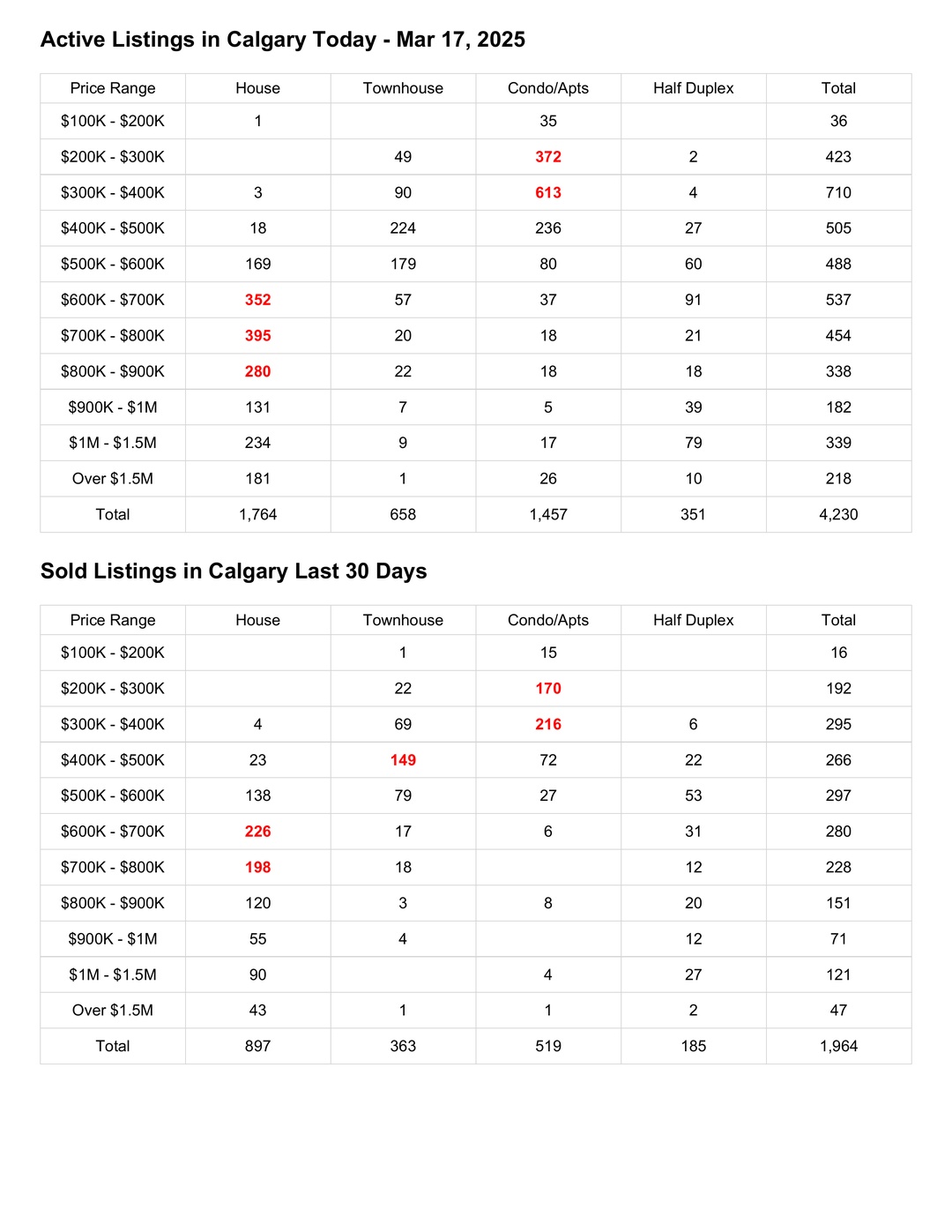

Price Range – Every MLS listing falls into a price category. What’s yours?

Property Type – Are you searching for a condo, townhome, or detached home?

Location – Do you want all of Calgary, a specific quadrant, or just a few communities?

Supply and Demand in Your Real Estate Market Niche

Once you’ve defined your market, it’s time to analyze supply and demand:

Active Listings – How many homes are for sale in your niche? (Supply)

Homes Sold in the Last 30 Days – How many are actually selling? (Demand)

Sales-to-Listings Ratio – What percentage of active listings are selling? (Market Balance)

What Type of Market Are You In?

Your real estate market falls into one of three categories:

Buyers’ Market – Less than 50% of listings are selling. More choices, less urgency.

Sellers’ Market – More than 50% of listings are selling. Fewer choices, higher competition.

Balanced Market – Around 50% of listings are selling. A stable environment.

Understanding your real estate market gives you a competitive advantage—whether you’re buying or selling.

You’ll know if you’re up against heavy competition or have the upper hand. That knowledge shapes your strategy and decisions.

Your real estate market is not the Calgary real estate market.

Your market starts with your price range and property type—not city-wide statistics.

Define your market, analyze supply and demand, and focus on what truly matters to you.

The numbers don’t lie. Make them work for you. We can help.